STOP guessing when you'll be debt-free

The Calculator That Breaks the Debt Cycle: Instantly Know Your Debt Freedom Date And How Much You'll Save - In Less Than Five Minutes

You're drowning in minimum payments and no idea when it ends

"I make my payments every month, but my balances barely move. At this rate, I'll be paying these credit cards forever. "

I know exactly how you feel. You're doing everything "right" - making your payments on time, maybe even throwing a little extra at your debt when you can - but you have no idea when this nightmare actually ends.

Every month feels the same:

Watching your credit card and student loan balances creep back up despite making payments

Having no clue how much of your payment goes to interest vs. actually reducing debt

Wondering if you're even attacking the right debt first

Feeling paralyzed because you can't see the finish line

Losing motivation because progress feels invisible

You've tried to figure this out before:

BUDGETING APPS (They track spending but don't show you the actual math of getting out of debt)

ONLINE CALCULATORS (They don't save your data, and you forget the numbers as soon as you close the tab)

SPREADSHEETS (You started one but got overwhelmed by the formulas and gave up)

JUST WINGING IT (Paying whatever feels right each month with no real strategy)

You felt like you needed a math degree just to figure out when you'd be free.

Then I Discovered The One Tool That Changed Everything...

After helping my wife and I eliminate over $15,000 in debt in under 12 months, I realized something shocking:

Most people stay in debt longer than necessary because they can't see their path to freedom

According to financial research, the average American takes over 15 years to pay off credit card debt.

But here's what's even more disturbing:

They could have been free in less than 3 years with the right strategy and the ability to see their progress.

Here's what I discovered after analyzing debt payoff success stories:

They didn't need complex software or expensive financial advisors

They didn't need to work 80-hour weeks or sacrifice everything

They needed a simple calculator that showed them EXACTLY where they stood

They needed to see their freedom date to stay motivated

But most alarming of all:

Most people are unknowingly paying THOUSANDS more in interest than necessary because they're attacking the wrong debt first.

I know because I was making all these same mistakes...

Through extensive research and plenty of trial and error, I discovered what actually works.

I call it the "The Debt Freedom Calculator & Tracker"

By following this mathematically-based system, you can:

Know your exact debt freedom date in under 5 minutes

See exactly how much interest you will save

Stop wondering if you're doing it right and start knowing

Track your progress month-by-month with confidence

Finally have the motivation that comes from seeing the finish line

After using this system myself and sharing it with others who've replicated these results, I've refined this calculator into a plug-and-play tool that anyone can use...

...even if you failed at budgeting, hate math, or have never used a spreadsheet before.

The 3 CRITICAL QUESTIONS This Calculator Answers Instantly

Question #1: Which Debt Should I Tackle First?

Discover the optimal order to pay off your debts - No more guessing. No more wondering if you're doing it wrong. The calculator shows you exactly where to focus.

Question #2: When Will I Exactly Be Debt-Free?

Stop living with vague anxiety about "someday." The calculator gives you your exact freedom date - the specific month and year you'll make your final payment. Print it. Screenshot it. Make it your phone wallpaper. This is the day your life changes.

Shift #3: How Much Interest Am I Really Paying?

See the brutal truth about what debt is costing you every single day, month, and year. Then see how much you'll SAVE by following the calculator. The savings calculator alone is worth 100x the price of this guide.

INSTANT ACCESS - START YOUR DEBT FREEDOM JOURNEY TODAY

Here's Everything You Get With The DEBT FREEDOM CALCULATOR & TRACKER TODAY!

What's included:

📊 The Ultimate Debt Freedom Calculator: Your plug-and-play calculator that does all the math FOR you:

Pre-Built Formulas - Just enter your numbers and watch it calculate everything automatically

Freedom Date Calculator - Get your exact debt-free date instantly

Interest Savings Calculator - See how much money the avalanche method and snowball method saves you

No Excel Skills Required - Simple, color-coded, and easy to use

Progress Dashboard - Visual charts showing your journey to freedom

Month-by-Month Breakdown - Watch your debt decrease month after month

Acceleration Scenarios - See what happens when you add extra payments

🎁 Plus The Complete 19 Page Debt Freedom Tracker Bonus Guide 🎁

Understanding Your True Debt Cost - Know what you're REALLY paying and why credit card companies want you to continue paying minimum payments

Avalanche vs. Snowball Comparison - Use YOUR actual numbers to see which method motivates you most to pay off your debt

The Interest Savings Maximizer - Payment timing hacks and strategies that save you thousands

Normally: $97

Today: $4

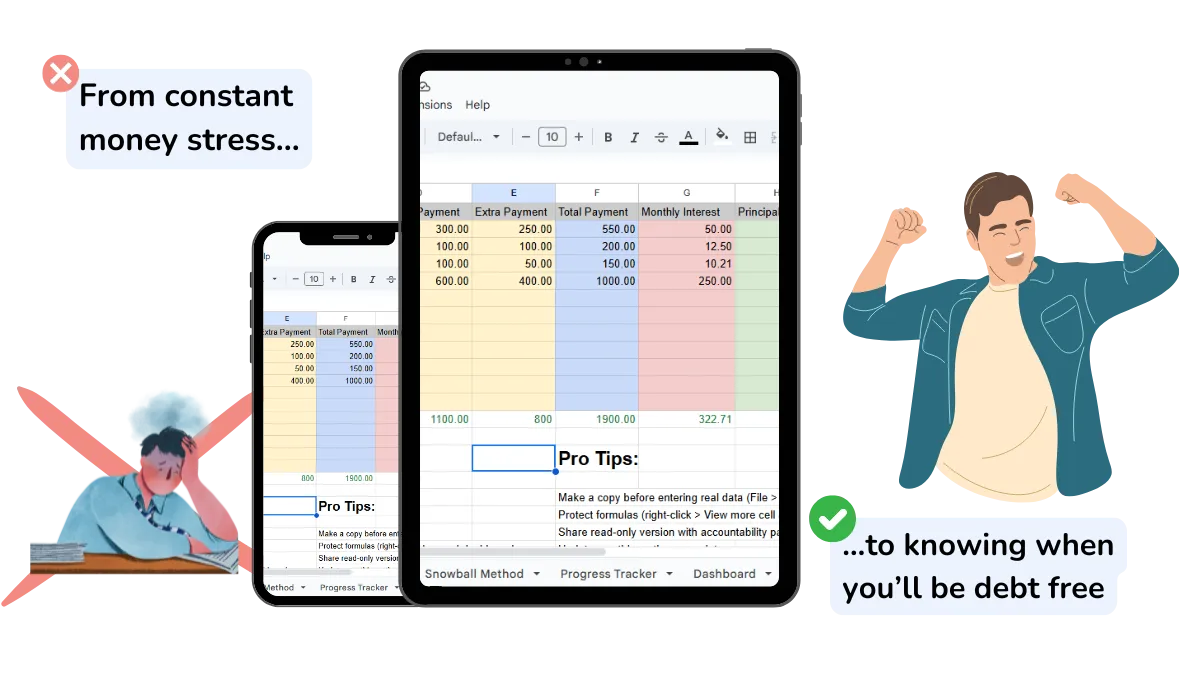

BEFORE AND AFTER

The Transformation You Can Expect

Don't let debt continue dominating your financial life. Your peace of mind can be stronger than ever - you just need the right system to make it happen.

Before The Debt Freedom Calculator:

No idea when you'll be debt-free - just vague hope it'll be "someday"

Guessing which debt to pay first - probably attacking the wrong one

Can't see if you're making progress - feels like treading water

Losing motivation - because you can't see the finish line

Paying thousands in unnecessary interest - without even knowing it

Feeling overwhelmed - by complex calculators and confusing advice

After The Debt

Freedom Calculator:

Know your exact freedom date - circled on your calendar, driving you forward

Attacking debts strategically - in the optimal order that works for you

Watching progress happen - with trackers that show every victory

Staying motivated - because you can see yourself getting closer every month

Saving thousands - by following these proven debt paying methods

Feeling confident and in control - with simple tools that actually work

YOUR DEBT FREEDOM PATH BEGINS HERE

Everything You Need In TWO Simple Components:

COMPONENT 1: THE ULTIMATE DEBT FREEDOM CALCULATOR

Instant calculation of when you'll be debt-free

See exactly how much interest each payoff method saves you

Instantly see how extra payments change your timeline

COMPONENT 2: THE 19-PAGE DEBT FREEDOM TRACKER

Using YOUR actual numbers from the calculator, see which method suits your personality and will achieve your debt-free goal

Understand the opportunity cost of staying in debt. (Warning: These numbers will either motivate you or make you angry. Probably both.)

Transform Your Financial Life Today

While other people stay trapped in the endless debt cycle with no clear plan, you'll know your exact path to freedom

Get The Debt Freedom Calculator + Tracker Now

COPYRIGHT 2025 | OEBMONEY.COM | PRIVACY POLICY | TERMS & CONDITIONS | BLOG

DISCLAIMER: Please understand results are not typical. Your results will vary and depend on many factors including but not limited to your background, experience, and commitment level. All business entails risk as well as consistent effort and action.

NOT FACEBOOK: This site is not a part of the Facebook™ website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook™ in any way. FACEBOOK is a trademark of FACEBOOK, Inc. DISCLAIMER: Please understand results are not typical. Your results will vary and depend on many factors including but not limited to your background, experience, and work ethic. All business entails risk as well as taking regular and consistent effort and action.

Nothing on this page, any of our websites, or any of our content or curriculum is a promise or guarantee of results or future results, and we do not offer any legal, medical, tax or other professional advice. Any potential results referenced here, or on any of our sites, are illustrative of concepts only and should not be considered average results, exact results, or promises for actual or future performance.

The information provided in this guide is for general educational and informational purposes only. It is not intended as, and should not be construed as, financial, investment, or legal advice. By accessing this website or purchasing any product, you acknowledge that you are entering into an agreement with EverDoc Digital LLC, not with any individual member, manager, or employee personally.

Everyone’s financial situation is unique, and the strategies or examples shared here may not be appropriate for your individual circumstances. Before making financial decisions, you should consult with a licensed financial advisor, accountant, or other qualified professional who understands your specific situation.

We make no guarantees regarding financial outcomes. Your success depends on many factors, including your personal effort, discipline, and circumstances.

Use caution and always consult your accountant, lawyer or professional advisor before acting on this or any information related to a lifestyle change or your business or finances. You alone are responsible and accountable for your decisions, actions and results in life, and by your registration here you agree not to attempt to hold us liable for your decisions, actions or results, at any time, under any circumstance.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.